As we delve into the realm of smart homes and their influence on homeowners insurance, a fascinating journey unfolds. Discover how cutting-edge technology not only enhances our daily lives but also potentially reduces insurance costs.

Let's explore the different facets of smart home systems, the factors affecting insurance premiums, and the types of devices that could lead to discounts.

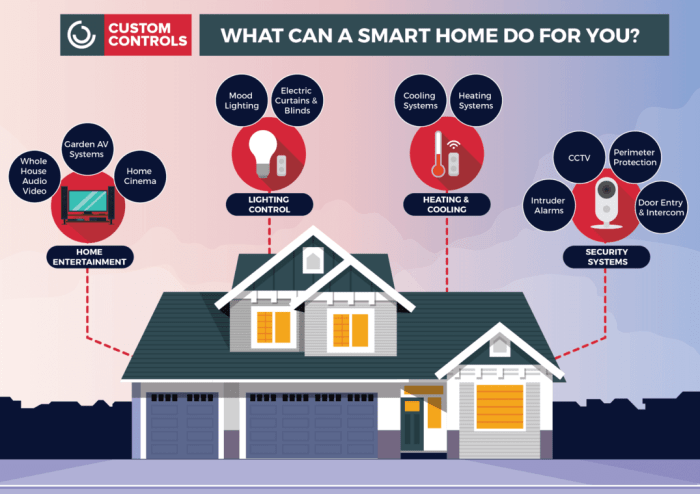

What Are Smart Homes?

Smart homes are residences that are equipped with a variety of devices and systems that are connected and automated to enhance the residents' quality of life. These homes utilize cutting-edge technology to allow homeowners to control various aspects of their homes remotely or through voice commands.

Components of a Smart Home System

- Sensors: These devices detect changes in the environment, such as motion, temperature, or light.

- Smart Thermostats: These devices regulate the temperature in the home based on the residents' preferences and habits.

- Smart Lighting: Lighting systems that can be controlled remotely or set on schedules to save energy.

- Smart Security Systems: Cameras, door locks, and alarms that can be monitored and controlled from anywhere.

Benefits of Smart Home Technology

- Convenience: Smart homes allow for seamless integration of devices and systems, making daily tasks easier and more efficient.

- Energy Efficiency: By automating lighting, heating, and cooling systems, smart homes can help reduce energy consumption and lower utility bills.

- Security: Smart security systems provide homeowners with peace of mind by allowing them to monitor their homes remotely and receive alerts about any suspicious activity.

- Safety: Smart homes can detect dangers such as smoke or carbon monoxide and alert residents to potential hazards.

How Do Smart Homes Impact Homeowners Insurance Premiums?

Smart homes can have a significant impact on homeowners insurance premiums by reducing risks and potential damages. Insurance companies take various factors into consideration when determining premiums, and smart home technology can play a role in lowering these costs.

Factors Considered by Insurance Companies

- Location of the property

- Building materials and construction of the home

- Security features in place

- Previous insurance claims history

Reducing Risks with Smart Home Technology

Smart home devices can lower insurance premiums by reducing the risks of theft, fire, and water damage. For example, smart security systems with cameras and sensors can deter burglars and alert homeowners and authorities in case of a break-in.

Examples of Smart Home Devices for Insurance Discounts

- Smart doorbells with cameras

- Smart smoke detectors

- Smart thermostats

- Water leak detectors

Types of Smart Home Devices That Lower Insurance Costs

Smart home devices are revolutionizing the way we protect our homes and belongings, leading to potential savings on homeowners insurance premiums. Let's explore some common types of smart devices that can help lower insurance costs and how they contribute to risk mitigation and loss prevention.

Smart Security Systems

- Smart security systems, such as cameras, motion sensors, and smart locks, provide real-time monitoring and alerts for any suspicious activity.

- These devices act as deterrents for potential intruders and help homeowners respond quickly to emergencies, reducing the risk of theft and property damage.

- Insurance companies often offer discounts for homes equipped with smart security systems due to the decreased likelihood of break-ins and vandalism.

Smart Smoke Detectors

- Smart smoke detectors can detect smoke and fire early on, sending alerts to homeowners and emergency services even when they are away from home.

- By providing early warnings and reducing response times, these devices help prevent extensive fire damage and potential loss of life.

- Insurance providers may offer lower premiums for homes with smart smoke detectors, recognizing the proactive approach to fire safety.

Smart Water Leak Detectors

- Water leak detectors can identify leaks and flooding in real-time, helping homeowners mitigate water damage before it becomes a costly issue.

- By minimizing the risk of water-related incidents, these devices can prevent mold growth, structural damage, and expensive repairs.

- Insurers may incentivize the use of smart water leak detectors by offering discounts on premiums to homeowners who invest in these devices.

Installation and Maintenance Requirements for Smart Home Devices

When it comes to smart home devices, proper installation and regular maintenance are crucial for optimal functionality. Ensuring that these devices are correctly set up and well-maintained can help you reap the benefits they offer while also potentially lowering your homeowners insurance premiums.

Installation Process for Smart Home Devices

Each smart home device comes with its own unique installation process. It is important to carefully follow the manufacturer's instructions to ensure that the device is set up correctly. Some devices may require professional installation, while others can be easily installed by homeowners themselves.

Proper installation not only ensures that the device functions as intended but also reduces the risk of malfunctions or accidents.

Importance of Regular Maintenance

Regular maintenance is key to keeping your smart home devices running smoothly. This includes checking for software updates, replacing batteries as needed, and ensuring that the devices are clean and free from any obstructions. By maintaining your smart home devices regularly, you can prolong their lifespan and prevent potential issues that may lead to insurance claims.

Tips for Proper Installation and Maintenance

- Read and follow the manufacturer's instructions carefully during installation.

- Consider professional installation for complex devices to ensure proper setup.

- Set up a schedule for regular maintenance tasks, such as checking for updates and changing batteries.

- Keep the devices clean and free from dust or debris that may affect their performance.

- Monitor the devices for any signs of malfunction and address issues promptly.

Insurance Companies Offering Discounts for Smart Home Technology

Smart home technology has become increasingly popular among homeowners due to its convenience, security, and potential cost-saving benefits. Insurance companies have taken notice of this trend and are now offering discounts to homeowners who have installed smart home devices. These devices can help reduce the risk of accidents or damage to your property, which in turn can lower your insurance premiums.

Criteria for Discounts

- Insurance companies may require homeowners to install specific smart home devices, such as smart locks, security cameras, smoke detectors, or water leak detectors, to be eligible for discounts.

- Homeowners may need to provide proof of installation and maintenance of these devices to qualify for discounts.

- The level of discount offered by insurance companies may vary based on the type and number of smart home devices installed in the home.

Examples of Insurance Companies

- Allstate: Allstate offers a discount of up to 25% on homeowners insurance premiums for those who have installed smart home devices that can help prevent or mitigate damage.

- State Farm: State Farm provides discounts for homeowners who have installed smart thermostats, security systems, and water leak detectors to protect their homes.

- Progressive: Progressive offers discounts for policyholders who use smart home devices to monitor their homes remotely and detect potential risks.

Final Wrap-Up

In conclusion, smart homes offer more than just convenience; they can also be a strategic investment in safeguarding your home and lowering insurance expenses. With advancements in technology, the future of homeowners insurance looks brighter and smarter.

FAQ Section

What are the benefits of smart home technology beyond insurance considerations?

Smart home technology not only provides convenience but also enhances security, energy efficiency, and overall home management.

Which insurance companies offer discounts for smart home technology?

Some insurance companies like State Farm, Allstate, and Liberty Mutual offer discounts for homeowners with smart home devices installed.

How do smart home devices contribute to risk mitigation and loss prevention?

Smart devices like smart locks, security cameras, and water leak detectors help in early detection and prevention of potential risks, reducing the likelihood of insurance claims.